AI Arrives In The Middle East: US Strikes A Deal with UAE and KSA

5 GW Datacenter, HUMAIN, G42, Diversion and Misuse Risks, Security Requirements, American AI Wins

The US has signed two landmark agreements with the United Arab Emirates and Kingdom of Saudi Arabia (KSA) that that will noticeably shift the balance of power. The deals have economic, geopolitical, and national security implications and taken together we believe these bilateral deals reinforce America’s claim to AI leadership. They also raise real concerns – but none that the US can’t address.

These deals do not weaken compute availability for the US, rather they strengthen them. We believe that these agreements are transformative and set to take AI infrastructure accessible to American AI to the next level, while alleviating bottlenecks like power. All American infrastructure suppliers are set to benefit. From GPU makers to AI Labs to Clouds, and more.

The new U.S. pacts with the UAE and Saudi Arabia reshape the AI landscape on three fronts:

Macro. By sidestepping the old AI‑Diffusion export‑control framework, Washington has opened a trillion‑dollar floodgate of capital for AI infrastructure. That inflow outweighs any drag from looming tariff fights and will finance build‑outs not only in the Gulf but back home, putting more racks of GPUs on U.S. soil.

Geopolitical. Abu Dhabi and Riyadh are now tied more closely to U.S. technology stacks. If Washington enforces tight security protocols, the alliances will deepen the region’s reliance on American hardware and software and pull both states further into the U.S. orbit.

Infrastructure. Energy‑rich Gulf nations join the roster of trusted partners just as U.S. data‑center grids hit their physical limits. Europe could have relieved the bottleneck but stumbled on power shortages and slow permitting. The Middle East, flush with cheap energy and capital, is poised to become the next regional AI hub.

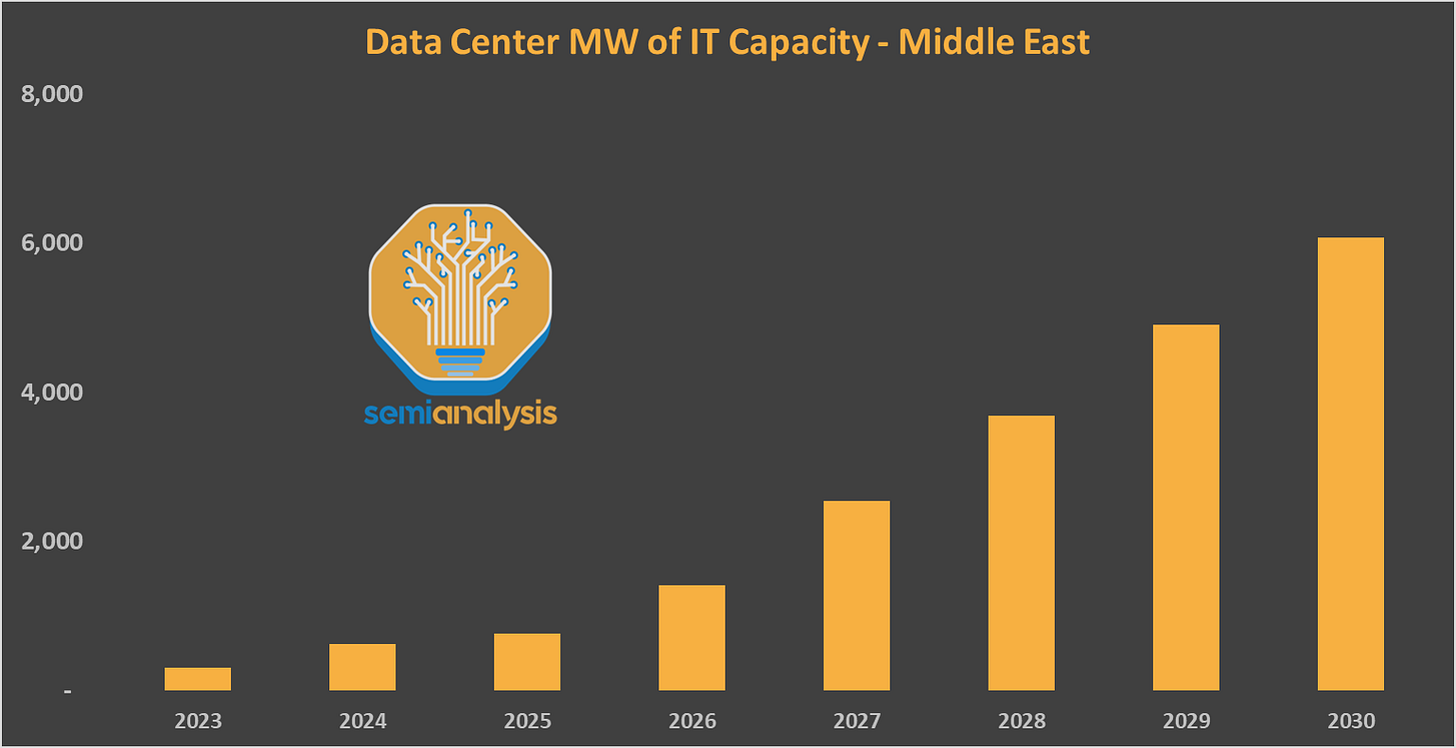

This announcement is no surprise to us. Our datacenter model has long flagged the Middle East’s rise: we forecast north of 6 GW of operational datacenter capacity by 2030 – and believe there is still significant upside risk. In addition, our Accelerator model shows the UAE’s G42 alone ordering hundreds of thousands of GPUs for 2026. We track these projects building-by-building and quarter-by-quarter.

With capital, energy, and policy now aligned, the Gulf is set to propel global AI infrastructure, and U.S. tech leaders will ride that wave of capital. Below we detail the timing and scale of the two new deals, their geopolitical upside, and the security risks. Behind the paywall you’ll find the hard numbers: how the pacts reshape AI-accelerator and datacenter supply chains.

UAE & KSA Deals: The Macro View

This week, the US announced a $600B deal with Saudi Arabia. With the UAE, the US announced a 5GW datacenter campus led by G42 with an initial 1GW phase. Let’s explore the details.

USA/UAE Partnership and G42's Rise

There are two key highlights to the U.S.–UAE pact:

Abu Dhabi’s G42, a state-backed AI powerhouse, a guaranteed import quota of 500,000 of Nvidia’s top-tier chips each year. G42 will keep 20% of the haul for its own GPU cloud and datacenter builds; the balance goes to U.S. companies.

G42 alongside US partners will build a 5GW AI datacenter campus – the region’s key hub to serve AI training and inference demands. The first 1GW phase has already broken ground. We provide more information on this project at the end of this report, and explain whether it is realistic or not.

G42 is by far the most dominant player in the UAE datacenter and compute market. Its colocation arm, Khazna Datacenters, runs massive campuses in Abu Dhabi and Dubai and is scouting new ground, including a 100 MW Turkish hub. Its Neocloud/Core42 unit operates GPUs worldwide—not only within Khazna’s UAE datacenters, but also from U.S. and African server rooms and planned outposts in France and Italy.

Microsoft, G42’s biggest customer and a $1.5 billion investor with a seat on the board, will be first in line for the new chips—and so will other U.S. hyperscalers. The result: a wider demand funnel for Nvidia, a deeper cushion for America’s compute shortfall, and an even faster-growing UAE datacenter market still dominated by G42’s GPU fleet.

Overall, we expect this deal to both accelerate and diversity the fast-growing UAE datacenter market – today still largely dominated by a single firm. US hyperscalers are set to ramp their investments. G42’s GPUs will also be used by hyperscalers.

The datacenter campus will utilise solar, gas, and nuclear power.

USA/KSA Partnership – HUMAIN and US Hyperscalers to Benefit

Saudi Arabia’s AI agreement follows a different playbook from the UAE’s. Folded into a $600 billion economic package, the deal rests on four pillars:

DataVolt. The kingdom’s top colocation developer will invest $20 billion in U.S. datacenters.

Inbound tech capital. Oracle, Google, Salesforce, AMD, and Uber will fund Saudi projects, led by Oracle’s $14 billion, ten-year commitment. With Datavolt included, cross-border outlays exceed $80 billion.

HUMAIN. The new Saudi AI firm plans to deploy up to 500 MW of AMD gear (≈ $10 billion) and an equal 500 MW of Nvidia systems over five years, beginning in 2026 with an 18,000 unit order for Nvidia’s GB300.

Ecosystem deals. HUMAIN signed a non-binding MOU with Qualcomm for CPU and edge-to-cloud AI silicon and a $5 billion accord with AWS to build an “AI Zone” that will run GenAI services on AWS platforms.

Saudi datacenter capacity is growing fast yet remains more scattered than the UAE’s. U.S. hyperscalers already dominate and intend to scale further. Local efforts trail G42’s maturity, and HUMAIN’s exact role, part cloud provider, part LLM-and-agent shop, has yet to come into focus.

Middle East Investments in US Infrastructure

Middle Eastern capital is now a two-way street. Datavolt, Humain, G42, and other Gulf players will pour tens of billions into U.S. AI infrastructure.

G42 is already on the ground: its Core42 unit runs a 10 MW datacenter in Fort Worth, Texas, and a 70 MW campus in upstate New York built by TeraWulf that could surpass 200 MW in 2026.

These early sites prove the model. With sovereign wealth funds joining the party, total commitments could approach one trillion dollars.

A Trillion-Dollar Capital Pool Unlocked

This new money cushions AI buildouts against a tougher credit market and tariff jitters. Two forces have raised the sector’s sensitivity to financial conditions:

Scale. Hyperscalers once self-funded expansions, but 2025–26 projects are too large to carry alone. Even cash-rich giants now lean on Apollo, Blackstone, Brookfield, and others.

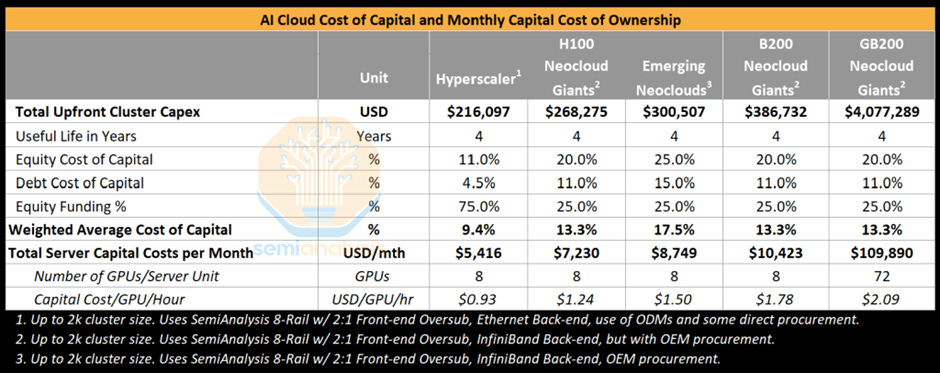

Neoclouds. More than 150 GPU-cloud startups help AI labs cut time-to-market. Their weaker credit and high capital costs mean a single rate hike can kill a project.

The Middle East can plug both gaps. Lowering financing costs, and keeping the AI infrastructure buildout rolling.

The Middle Eastern players have a huge advantage in cost of capital versus US hyperscalers and as such their infrastructure will be incredibly low cost. Whole the US hyperscalers have to cash to invest they don't have the stomach for speculative investments. CFO’s like Amy Hood are breathing down the necks of all investment decisions, which caps investment growth despite extremely high utilization of AI infrastructure. The Middle East capital coming into the US and Middle East is leading to an acceleration in spend.

Overall, we view these deals as extremely positive for US AI companies.

Winning Over The ME Before China Has The Chance

This deal also further locks in the Middle East as a key customer of US technology – at the expense of rival nations like China. Their champion Huawei does not currently have enough capacity to sell Ascend chips outside of China, and as such, this ensures full adoption of US hardware before China can even gain market share.

These deals come the same week as the Department of Commerce issued guidance to industry that use of Huawei Ascend chips anywhere in the world is deemed an export control violation.

Next we will size UAE and Saudi orders against global accelerator supply. Some fear the Gulf build-out will drain GPUs from U.S. labs and hyperscalers; we argue the opposite—Western buyers stand to gain. We also cover Gulf datacenter expansion and U.S. power constraints behind the paywall.

Geopolitical Risk and Security Concerns

The UAE is already woven into the U.S. security fabric. American forces operate bases there, and the sovereign fund Mubadala owns 82 percent of GlobalFoundries, a prime Pentagon chip supplier. Even so, a large-scale AI partnership raises two headline risks: GPU diversion to China and unauthorized model use. There are also security risks around AI model weights that we address.

Diversion Risk

There have been worries that providing GPUs to the UAE will only serve as pitstop for them to go to China. We think this concern is overplayed and unlikely. The majority of compute will be either operated by US hyperscalers, by firms like G42 who are closely linked, or providing compute to US hyperscalers and labs. Non-US operations is a tiny portion of the pie.

Nevertheless, there are ways to make sure frameworks are installed to ensure verifiable validation of GPU location. One thing that has been suggested is software-based telemetry that could relay location and system configuration back to Nvidia. This would then be shared with USG. Nvidia themselves have suggested this as a solution to smuggling. However, with physical access, this can be easily spoofed to show incorrect location of the GPU.

As such, physical inspections are key to ensuring the GPUs are where they are supposed to be. The White House is aware of the risks and is prepared to ensure the chips are where they are supposed to be. As Bloomberg reported:

The policy objective of preventing diversion to countries of concern is an absolutely important objective of the United States but it is not a difficult one to achieve. The truth of the matter is that all one would have to do is send someone to a datacenter and count the server racks to make sure the chips are still there.”

David Sacks, White House AI Czar

Misuse Risk

Malicious actors could rent Gulf GPUs to train or fine-tune harmful models. The remedy is strict Know-Your-Customer (KYC) rules. The joint U.S.–Emirati working group should install strict KYC guidelines for any customer which rents anything above a specific compute threshold, for example. This, in principle, ensures that the customer or renter of the GPUs are actors who have been vetted and known to not be, for example, entity listed.

In practice, this can be a challenge – as previous instances in the demonstrated by the semiconductor industry. For example, TSMC has made the majority of the Huawei Ascend dies through purchases made a shell company called Sophgo – and could be facing a considerable fine.

The working group has until these GPUs are operational to iron our details of the KYC requirements. It is critical to get them right as circumventing these checks can have significant consequences.

The Model Weight Risk: Four Layers

Training an advanced model can burn through billions of dollars in GPU time, data curation, and research salaries, yet the finished weights that embody all of that effort fit into only a few terabytes. Because they are compact, self-contained, and don’t require insight into the underlying algorithms, those weights are comparatively easy to steal. U.S. hyperscalers already treat them as crown jewels and wrap them in multiple layers of protection. Any GPUs that land in Emirati datacenters must travel with the same safeguards.

There are many parts to security across the stack, but these can roughly be thought of as 4 layers. A workable defense starts with the cyber layer. State-sponsored actors often attack GPU clusters, so the baseline should match what operators such as CoreWeave—our ClusterMAX Platinum–rated provider already deploy in the United States. There are also protections that need to be developed for internal use. As an example, CoreWeave places customers on single Kubernetes namespace isolation, isolating cluster tenants from each other.

The UAE should also fund US led red teaming efforts, ensuring vulnerabilities, including zero-day ones, are closed before attackers find them. Close cooperation with labs like Anthropic, OpenAI, and Google—each with years of incident data—will further refine the threat model. Investment in security practices sufficient to defend against highly resourced state actors is beneficial for protecting model weights when served in the UAE and the US.

The DoD and other national security agencies like the NSA should continue their cooperation with other international security agencies and further develop best practices for serving AI systems securely, building on top of previous work.

Hardware controls add a second barrier. Model weights should live inside secure enclaves on drives that tenant software cannot touch, and any channel through which weights could be transferred should be monitored and rate limited. Sudden spikes in egress are a tell-tale sign that someone is trying to siphon weights. Side-channel attacks are harder but still manageable if countermeasures are baked in before racks go live, so protecting the supply chain is equally critical.

Physical security remains essential. Unannounced inspections—quite literally counting the servers—give regulators a quick way to verify that every GPU is still in place and hasn’t slipped across a border. Monitoring and recording of spaces within and around the datacenter are critical here.

Human-intelligence safeguards is another layer. Social engineering tactics like bribes, candidate placement and other techniques that can place insiders that could compromise important information. As such, background screens, insider-threat training, and continual liaison with U.S. and Emirati intelligence agencies to ensure correct implementation and defence.

Below, we discuss exactly how the deal benefits the US Hyperscalers, the strong US datacenter deficit, the Middle East's growing infrastructure, and cover exact details of how the datacenters will be powered.