Microsoft's Datacenter Freeze - 1.5GW Self-Build Slowdown & Lease Cancellation Misconceptions

OpenAI Shift, Oracle & Stargate Acceleration, Hyperscale Capex Implications, Vertiv's Impact Misunderstood, Copilot Weak Adoption

Over the last few months, there have been a number of headlines raising concerns about Microsoft's reduction in datacenter leasing activities including a few datacenter leasing cancellations. We called out Microsoft’s exit of multiple datacenter leasing contracts to our datacenter model clients on December 17th (two months before the Wall Street headlines). This story isn't as simple as it seems and there is a lot more nuance to Microsoft's actions.

The market has been focusing on "2GW of lease cancellations" which only covers non-binding LOIs, not firm contracts. This fails to mention that Microsoft has ~5GW of pre-leased capacity under binding contracts that will start operations between 2025 and 2028. In reality, Microsoft walked away from significantly more than 2GW of non-binding contracts over the last 2 quarters. The firm was in discussion with virtually every single vendor for capacity in mid-2024 and has since completely frozen new leasing activity.

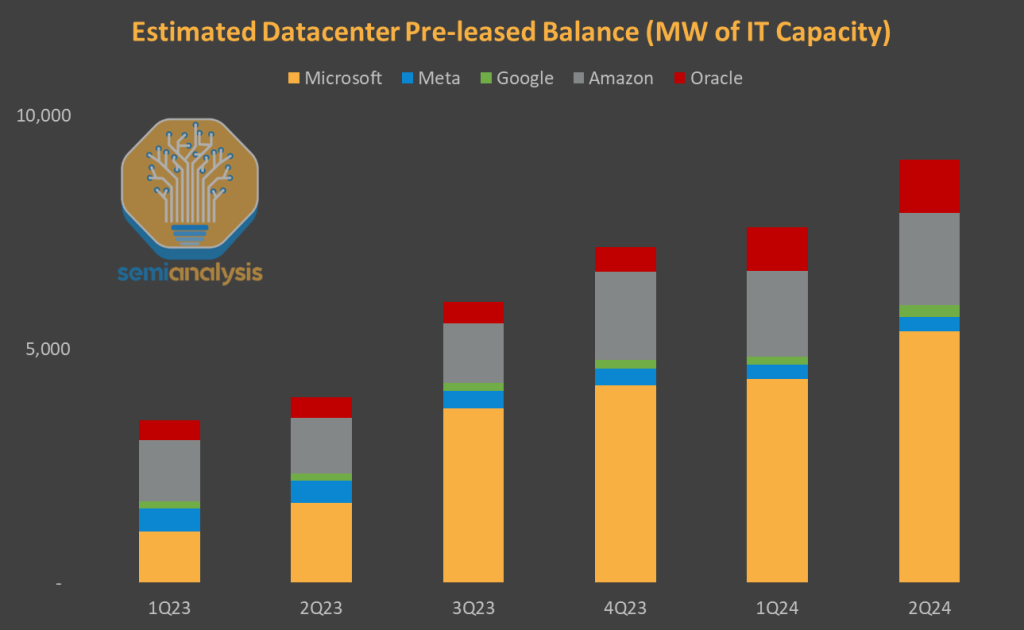

The chart below provides a perfect illustration. Microsoft singlehandedly drove the leasing market in 2023 and the first half of 2024. Not only was it aggressively signing deals, but it was also effectively “freezing” the market by locking up non-binding LOIs across the board. Our estimates suggest Microsoft accounted for more than 60% of all new leased turnkey capacity from Q1 2023 through Q2 2024. In June 2024, Microsoft's preleased capacity was larger than that of the four other major hyperscalers combined.

This happened at the same time as Microsoft significantly ramped up its self-build efforts, acquiring tens of thousands of acres around the US and the globe, accelerating construction of existing sites and securing gigawatts of power for future sites . Taken together, these moves signaled Microsoft's preparation for what was the most ambitious infrastructure buildout in history.

While the leasing slowdown is material, these changes are not material to the short and medium term and only impact 2027+. The more important slowdown of Microsoft's changes to their self-build datacenter plans. Our research indicates that Microsoft is freezing 1.5GW of near term self-build datacenter projects - projects that were previously scheduled to go online in 2025 and 2026.

Microsoft is freezing multiple (but not all) self-build projects across the globe with an immediate impact on capacity for 2025 and 2026 – as highlighted earlier to our Datacenter Model clients. Numerous multi-hundred-MW Microsoft campuses have shown underwhelming progress, despite our research indicating that these projects have secured energy and all necessary approvals. This is a deliberate move by Microsoft to slow the expansion of its self-built capacity.

The photos below illustrate the stalled development across several of its US datacenter projects - and there are many more. Slight progress is being made on the groundwork, but Microsoft has frozen construction of actual shells and delayed or cancelled orders for cooling and electrical equipment. Progress is materially slower than the pace at which the firm had been developing self-build campuses in 2023 and 2024. Below we will make sense of Microsoft's strategic shift.

Microsoft’s capacity growth is misunderstood by the market, and the impact on equipment suppliers such as Vertiv is largely different from what has been suggested by analysts. Amateur confusion led a Wall Street analyst to forecast a material weakness in Vertiv's orders prior to Q1 25 earnings.

They misunderstood that a large portion of Microsoft's ~5GW preleased capacity is not yet in Vertiv's orderbook. And this is just one of many other major misconceptions - we explain the real impact on Vertiv at the end of this report.

What caused Microsoft's strategic shift, and what are the consequences to datacenter equipment suppliers like Vertiv, and the broader GPU and AI infra market ? Despite a 1.5GW self-build pause and a freezing of all new leasing activity, the implications are not as gloomy as it seems. We explain everything below.